Kleven, a ship building company, has awarded a £25m contract to Rolls-Royce to provide ship design and equipment to Hurtigruten’s new polar cruise vessels.

The contractual scope includes the supply of technology, including Rolls-Royce’s Unified Bridge, a human-machine interface of a broader and deep integration of ship systems, and equipment required for the cruise vessels.

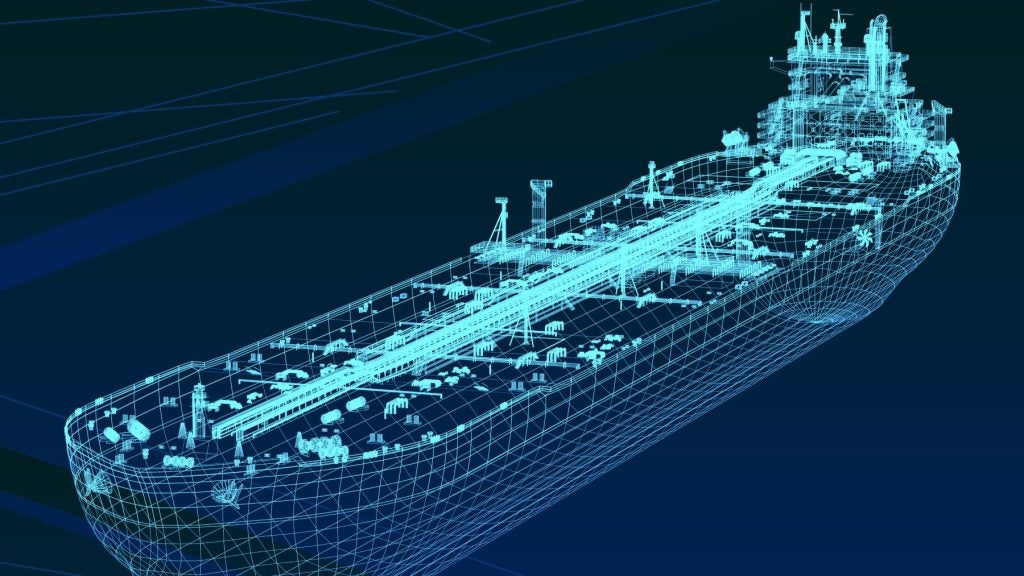

Stolt-Nielsen, a bulk-liquid transportation provider based in the UK, intends to acquire Jo Tankers’ chemical tanker operations, which includes 13 chemical tankers and a 50% share in a joint venture with eight new-build chemical tankers, for a deal worth approximately $575m.

The acquisition will cover tonnage replacement needs of Stolt-Nielsen’s existing chemical tanker fleet for the next several years, while providing the company with operational savings. Further, it will add new trade routes and enable business expansion on key trade lanes, allowing the company to better serve the needs of its global customer base.

In a move to launch a landmark shipping fund, named APICORP Bahri Oil Shipping Fund (ABOSF), the Arab Petroleum Investments (APICORP) and the National Shipping Company of Saudi Arabia (Bahri) have signed an agreement.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWith a total investment target of $1.5bn, the ten-year fund aims to acquire 15 very large crude carriers (VLCCs) in three phases. APICORP, by investing 85% in the fund, will become the main investor and fund manager, while Bahri, which will invest the remaining 15%, will be the exclusive commercial and technical manager.

GE’s Marine Solutions has secured a contract to supply high-voltage system to the world’s largest semi-submersible crane vessel (SSCV), Sleipnir, which is currently under construction at Sembcorp Marine, for Heerema Offshore Services.

As part of the deal signed between GE and Sembcorp Marine, the former will provide the electrical part of the power and propulsion system, which comprises 12 sets of 8MW generators, eight units of 5.5MW propulsion motors, medium-voltage switchboards, transformers, and MV7000 drives.

The power system is designed in line with Lloyds Register’s Rules (DP AAA).

In a move to become a member of 2M Vessel Sharing Agreement (2M VSA), Hyundai Merchant Marine (HMM) has signed a memorandum of understanding (MoU) with 2M carriers, a major container shipping alliance that includes Maersk Line (ML) and Mediterranean Shipping Company (MSC).

The agreement will enable HMM to access 2M’s VSA network, which further allows it to boost its service offerings and achieve improved cost competitiveness. On the other hand, 2M will benefit by a service competency in Asia and improved network coverage in the Trans-Pacific area.

Image: ABOSF is a landmark shipping fund launched by APICORP and Bahri. Photo: courtesy of Bahri.