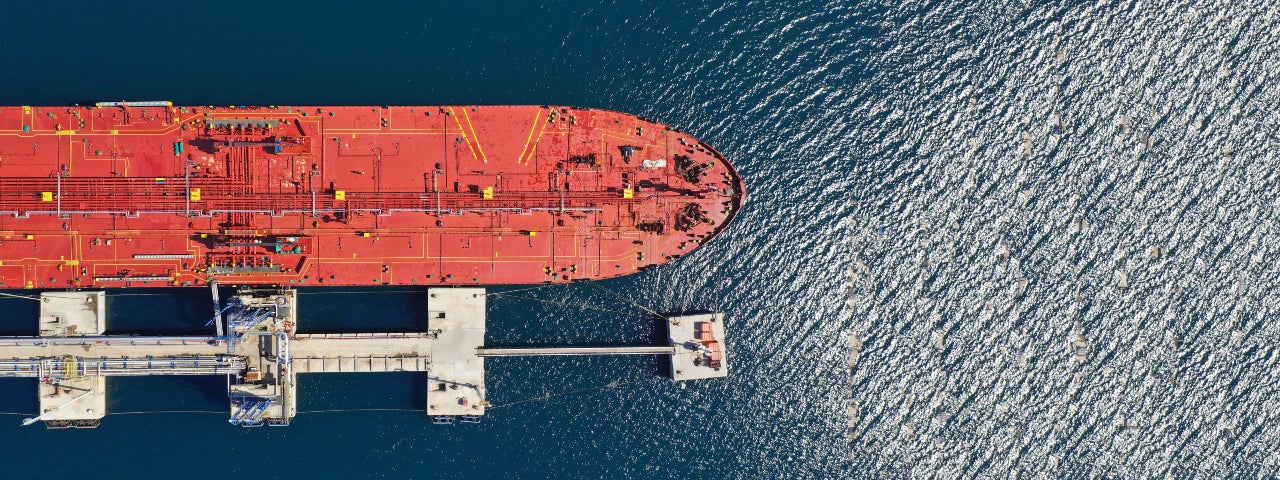

Belgium-based tanker shipping firm Euronav has entered a sale and leaseback agreement with Chinese investment management company Taiping & Sinopec Financial Leasing for a 2009-built very large crude carrier (VLCC), named Newton.

Formerly known as Maersk Newton, the 307,284dwt vessel was sold for $36m.

The vessel has been leased back by Euronav under a 36-month bareboat contract at an average daily rate of $22,500.

As part of a bareboat contract, a client pays a fixed daily or monthly amount for a fixed duration for using the vessel. The client also remits all the operating costs such as voyage and vessel expenses.

After the end of the contract, the vessel will be redelivered to its owners.

Euronav said that the deal has resulted in a capital gain of approximately $2.4m.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe transaction generated $19m of free cash after the existing dept was repaid.

Euronav CEO Hugo De Stoop said: “Euronav is pleased that we managed to execute another transaction with this leading Chinese counterparty as it is a trusted partner. By securing an excellent price for this vessel, we maintain the capability to purchase younger tonnage, using the generated revenues. This is consistent with our approach to fleet renewal.”

Earlier in February, Euronav announced a deal to acquire two eco-Suexmax newbuilds through a resale to renew its fleet.

The ships will possess the structural notation to be liquefied natural gas (LNG)-ready, and potentially, ammonia-ready.

Moreover, the newbuilds will be equipped with scrubbers and ballast water treatment systems.

Euronav’s owned and operated fleet currently consists of 45 VLCCs, 26 Suezmaxes, two V-Plus vessels, and two floating storage and offloading (FSO) vessels.