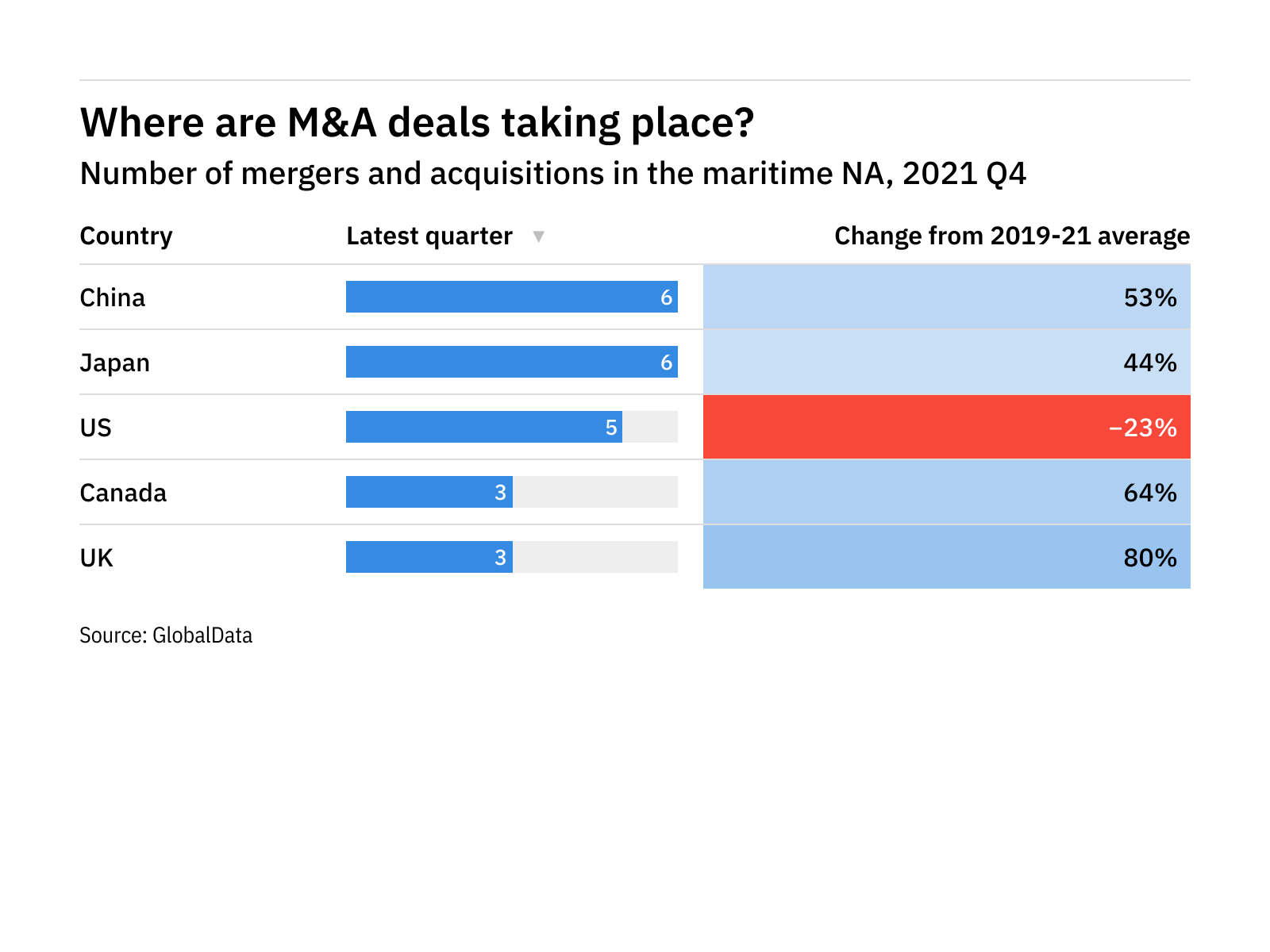

New figures released by GlobalData have shed light on the top locations for mergers and acquisitions in the maritime sector.

The data shows that M&A activity is strongest in China and Japan. China saw a total of six deals announced in the most recent quarter (2021 Q4). That’s down from seven deals announced in the previous quarter (2021 Q3).

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataJapan performed equally well over the most recent quarter, with six deals (up from five in 2021 Q3).

Which countries are emerging as M&A powerhouses?

Recent months have also seen an uptick in M&A deals in the US. The country has seen 29 deals announced over the last two complete quarters, up from an average of 13 deals every six months between 2019 and 2021.

That's the largest increase in M&A dealmaking in the maritime sector for any country.

Despite being one of the global hotspots for M&A dealmaking in the maritime sector, Japan has had a difficult few months, with just six deals announced in the last two quarters.

That's a decrease compared the country's average of eight deals announced every six months between 2019 and 2021, and the sharpest decrease in M&A dealmaking in the maritime sector experienced by any country in recent months.

Globally, the situation is looking mixed for mergers and acquisitions in the maritime sector.

A total of 39 deals were announced over the last quarter, down from 50 deals in the previous quarter but up from from an average of 33 deals per quarter over the previous three years.

GlobalData's deals database

GlobalData tracks the performance and activities of more than 675,000 companies in over 200 countries around the world.

The data analytics firm's deals database includes the details of approximately one million deals, ranging from mergers and acquisition to venture capital financing, equity offerings and debt offerings.

Data Journalism Team