In recent months, the global shipping industry has grappled with significant disruptions due to the Red Sea conflict, where Houthi militants have targeted “Israeli-linked” container ships following a three-month air bombardment by the Israel Defence Force of the occupied territory of Gaza.

Since late November 2023, the Houthis, controlling substantial parts of Yemen, have employed drones and missiles to intimidate merchant vessels transiting the Red Sea. Responding to these actions, the US and the UK conducted joint air strikes against Houthi targets in Yemen, emphasising ‘a necessity to protect global shipping’. However, the Houthis show little inclination to cease their campaign and Israel remains unresponsive to returning to negotiations with Hamas militants in Gaza.

The repercussions on the shipping industry and associated sectors have been significantly disruptive.

According to data from the global logistics technology platform Flexport, there has been a diversion of 25% of the world’s shipping capacity, leading to a surge in shipping rates. Rates from Asia to North America have risen by 75% in the last month, with an anticipated additional increase of 50% to 100% in January. Asia to Europe rates soared by 200%, prompting vessels to circumvent the Red Sea, resulting in an additional 10 to 14 days added to transit times.

Supply chain finance

Supply chain finance faces significant implications in the wake of these disruptions, exposing vulnerabilities and highlighting the need for resilience and risk mitigation. The situation urges industries to reconsider dependencies on just-in-time inventories and potentially accelerate the trend towards regionalisation of certain supply chains, a momentum that gained traction during the challenges posed by the Covid-19 pandemic.

See Also:

An essential response to enhance supply chain resilience has been the acceleration of nearshoring strategies. This involves relocating manufacturing or supplier operations to countries closer to the consumer base, aiming to mitigate risks associated with global disruptions and foster a more agile and responsive supply chain.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe UNCTAD’s most recent Global Trade Update, released in mid-December, paints a sobering picture, projecting a 5% decline in global trade by the end of the year compared to the record levels of 2022. This contraction equates to a substantial reduction of about $1.5 trillion, bringing global trade below $31 trillion.

In a statement, the UNCTAD expressed a “highly uncertain and generally pessimistic” outlook for 2024. The organisation cited persistent factors such as ongoing geopolitical tensions, escalating debt, and widespread economic fragility as contributors to this sombre forecast.

Yet, against this backdrop, global trade remains strong.

During a keynote address at the Supply Chain Finance Summit 2024 in Madrid, Marc Auboin, Senior Counsellor for Economic Research at the World Trade Organisation, emphasised to delegates that the primary source of instability in global trade is not geopolitical upheaval but rather “uncertainty in trade policies” and a rise in trade-restrictive measures.

Auboin provided additional context, noting that global trade may be slowing but that shouldn’t hide the significant emergence of new growth areas, particularly led by China. He also highlighted the resilience of global demand for imports and a significant uptick in trade services, driven by the recovery from the COVID-19 pandemic.

Freight leasing

In the immediate aftermath of the conflict, global shipping companies have emerged as short-term beneficiaries, with profitability from leasing containers (container freight rates) witnessing a significant upswing, notes Virginie Maisonneuve, Global Chief Investment Officer (CIO) with Allianz Global Investors.

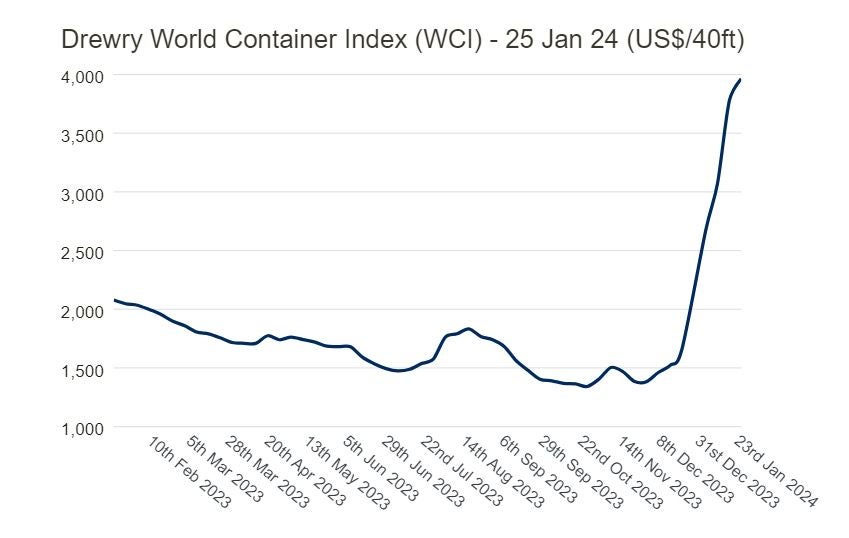

Container rates have risen by 61% over the past two weeks, according to the World Container Index. Many firms are diverting ships from the Red Sea to the longer alternative route around the Cape of Good Hope, adding approximately 10 days to the journey. Despite potential short-term gains, caution is warranted, as container rates may fall once hostilities ease, posing a challenge due to excess capacity.

Although Maisonneuve has noted a potential boost in profitability for shipping companies in the short term, she remains cautious about the outlook, anticipating challenges once hostilities ease.

SCFS24 showcases fintech’s role in mitigating risks for SMEs