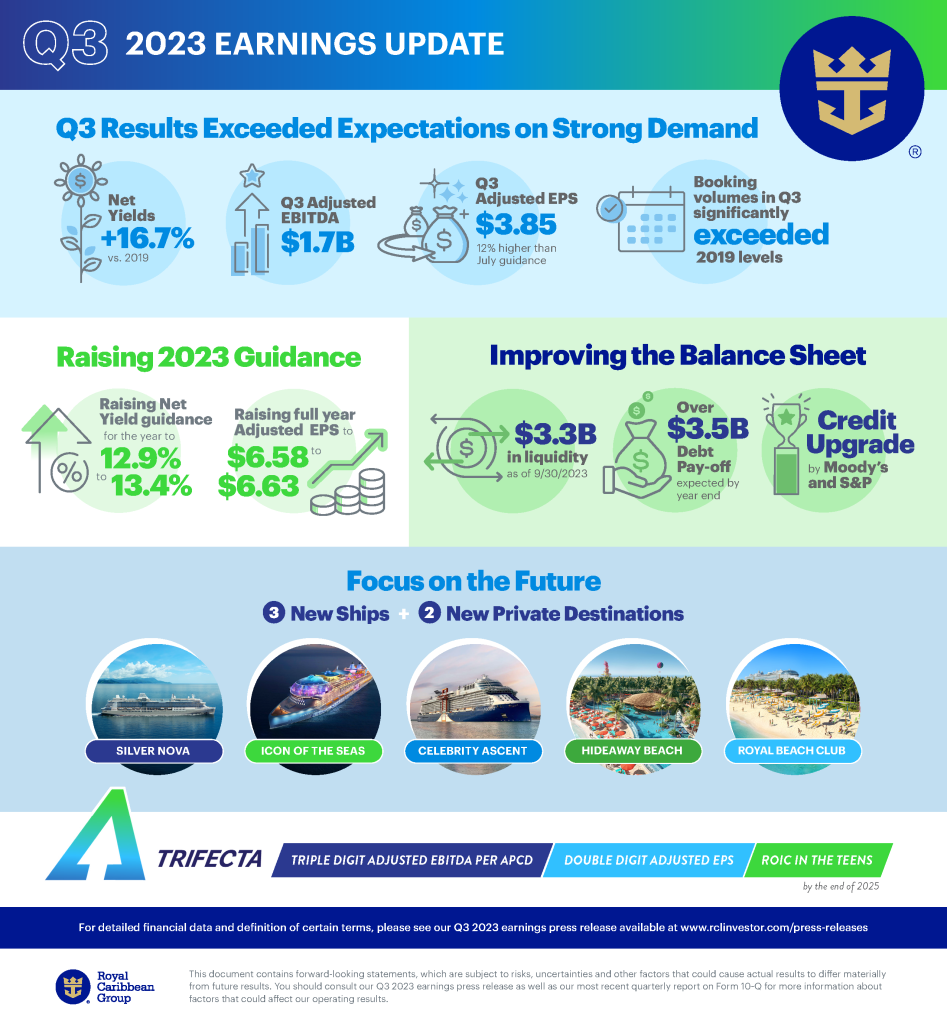

Cruise industry giant, the Royal Caribbean Group, has continued to show its strong post-pandemic recovery in its Q3 earnings report for 2023, recording a net income of $1bn or $3.65 per share, almost 30 times better than the same period in 2022.

The group attributed the results to increased spending on experiences and high load factors that helped deliver a net revenue of $4.2bn and an adjusted EBITDA of $1.7bn.

President and CEO Jason Liberty said: “The strength of our brands and the acceleration of consumer spending on experiences have propelled us towards another outstanding quarter and a robust 2023.

“Looking ahead, we see accelerating demand as we build the business for 2024. Our booked load factors are higher than all prior years and at higher rates, further supporting our trajectory towards the Trifecta goals.”

The results have also led the company to increase its adjusted earnings per share guidance for the full 2023 year from $6.58 to $6.63, with net yields expected to increase from 12.9% to 13.4% and an expected revenue of $2.6bn for Q4.

Revealed in 2022, the Trifecta programme is a three-year financial performance target seeking to build the company back to its high performance of 2019 before the pandemic.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe three goals include seeing a triple-digit adjusted EBITDA per APCD to beat the $87 record set in 2019, a double-digit adjusted earnings per share to beat the $9.54 2019 record and a return on invested capital in the teens, exceeding the 5% record.

Alongside improving on the 2022 results, Royal Caribbean’s Q3 earnings also represent a significant step up from 2021, when the company recorded an adjusted net loss of $1.2bn or $4.91 for the same period.

The company is already expecting to achieve its goals of exceeding its 2019 levels, with the group reporting that booked load factors and rates are all higher than in previous years with bookings for 2024 outpacing 2019 numbers.

Royal Caribbean will also be debuting its newest cruise ship and the largest in the world, the Icon of the Seas next year when it picks up its first passengers in Miami, Florida, in January for a Caribbean cruise.

The group’s cruise lines include the fully owned Royal Caribbean International, Celebrity Cruises and Silversea Cruises, as well as the co-owned TUI Cruises and Hapag-Lloyd Cruises.