Ask a roundtable of industry insiders what the fuel of the future is and it’s a fair bet that a few, if not most, will say liquefied natural gas (LNG). Some are full-blown believers; others less so. But looking at it neutrally, what is the rate of progress?

“LNG provides significant environmental benefits, it is a proven fuel and it is abundant on a worldwide basis,” says Peter Keller, executive vice president of TOTE – which operates the Marlin-class, LNG-powered container ships.

On the other hand, Ian Adams, chief executive of the Association of Bulk Terminal Operators, pulls no punches when asked why ship owners are gradually choosing to make LNG their fuel of choice. “I think they are seeing it as a quick fix,” he explains. “I just believe that rather than going for interim solutions, we should be putting more effort into the ultimate, long-term solutions, whatever they be, we don't really know.”

One of Adams’ main frustrations is with what he sees as false reporting. Last year he told how he was “dismayed” to see LNG being promoted as a solution for reducing greenhouse gas emissions (GHGs), and adds now that it is “misleading”. “It does have a slight impact for carbon, as there is less carbon in the fuel to start with, but there's also less energy in the fuel, so you have to burn more of it,” he explains.

When the question of GHGs is posed to Krispen Atkinson, a principal analyst with IHS Maritime and Trade, he highlights “methane slip”, or the loss of unburned methane. “[This] can happen anywhere along the supply chain, not just within the engine of the ship,” says Atkinson. “The impact of methane on global warming is potentially 28 times worse than carbon dioxide, so this is where the worries lie.” The focus, therefore, should be on ensuring no methane slip occurs, he adds.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataProgress, but below expectations

However, there is agreement – including from Adams – that LNG is one of the better ways to reduce sulphur oxide (SOx) and nitrogen oxide (NOx) emissions – something that is high on the agenda following the announcement that the International Maritime Organization (IMO) has set 2020 as the implementation date for the 0.50% sulphur limit on fuel oil used by ships operating outside designated SOx emission control areas (ECAs).

It’s no great surprise, then, that some shippers are eager to push on.

Back in 2012, DNV GL released a study that foresaw a global LNG-fuelled fleet of 1,000 ships by 2020. However, Martin Wold, DNV GL’s senior consultant, environment advisory, admits they have scaled that number down to around 600.

Speaking in January, Wold explains there are 99 LNG-fuelled ships in operation, “so we're eagerly awaiting number 100.” He continues: “There are 93 vessels confirmed in the order book, for delivery in 2017 and some even up to 2024.” Figures from November last year also show 70 ‘LNG-ready’ ships in operation or on order. These are designed to switch from conventional fuels to run on LNG.

But, were DNV GL and the wider industry overly optimistic in their previous projections? Wold acknowledges that he expected development to be faster, but highlights the well-documented drop in the oil price as an obstacle to the “exponential growth that we and many others had predicted.”

It’s obvious when speaking to Wold that he firmly believes in the merits of LNG: “The main benefits of course are around the environment; we've been quite clear on this for a long time. I believe we will have a healthier environment and better air quality in heavy traffic areas.” He is also buoyed by the fact that despite the drop in oil prices, there has been “stable” growth in the size of the fleet.

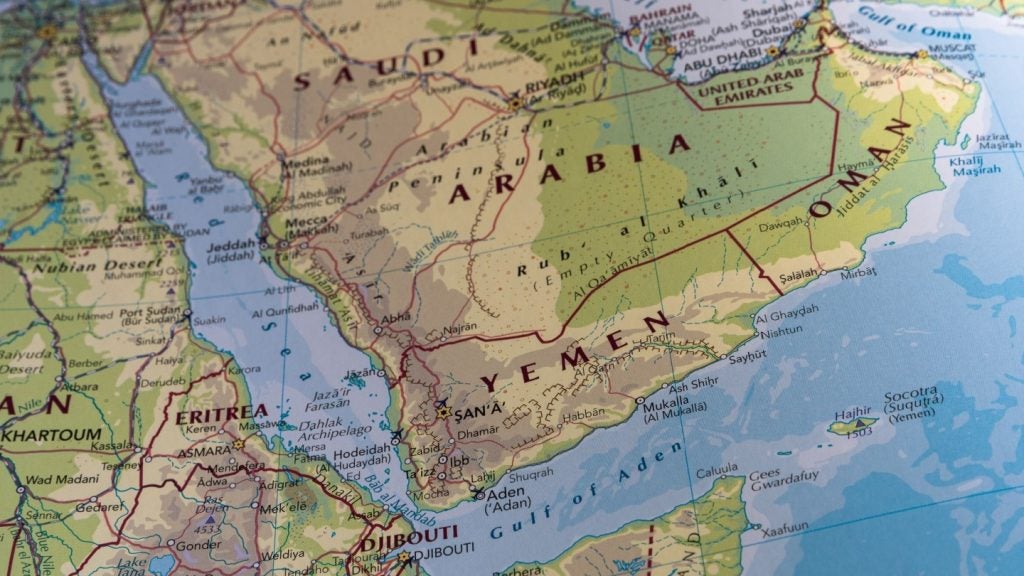

Build the bunkering hubs

Bunkering, however, is the one key that unlocks the door to greater progress. Atkinson says hubs are needed for LNG to become a global fuel and pinpoints the following locations: Las Palmas, Fujairah, Singapore, the Panama Canal and Gibraltar. “With LNG available in these areas, we are more likely to see more ocean-going/long-range operating vessels take up the fuel,” he adds. These hubs will be the consequence of ship owners saying, ‘we want to use LNG, let’s make it possible’.

Wold is in agreement, detailing how for LNG-fuelled ships, “we see that the majority of bunkering projects under development are in Europe.” Most of these, he adds, are concentrated around ECAs in the North and Baltic Sea.

A handful of examples are evidence of this. In August last year, the Port of Rotterdam carried out its first LNG bunkering on a sea-going vessel, the Ternsund, followed by a similar operation at the Skangas terminal in Finland in October.

In addition to this, an international focus group for LNG bunkering was established in 2014. In October last year, it welcomed the Port of Jacksonville, the Norwegian Maritime Authority and the Japanese Ministry of Land, Infrastructure, Transport and Tourism, as well as Korea’s Ulsan Port Authority.

However, this pace of progress is not consistent across the globe. “In North America, the pace of development has been somewhat slower than we expected, especially when we compare it to what we are seeing in Europe,” Wold explains. “We also see quite a few projects developing in Asia, but many of these are for inland waterway shipping.”

LNG: fit for the future?

It’s difficult to keep abreast of all the LNG-related projects globally, including those that are complete and others which are yet to fully develop. Will 2017 and the coming years further enhance the fuel’s growing reputation, or will alternatives emerge?

“I think it will probably be the same [as 2016],” argues Adams. “We're talking about shipping, and shipping doesn't change very quickly.”

Atkinson says it will not become the dominant maritime fuel “in this generation of ships”. With the necessary infrastructure, who knows? But until then, Atkinson believes it is most likely to be limited to coastal/regional operating vessels.

As for the potential alternatives, there’s talk of hydrogen fuel cells, and this is being looked at.

“We definitely believe in a mix of energy sources, both short and long-term,” states Wold. “There will also very likely be a number of niche fuels [and] battery-powered ships, for those that have short crossings, like ferries.”

For now, LNG is at the front of the queue. Any claim to being a panacea, however, cannot be proven at this time, if ever. What the fuel does do, though, is provide an alternative; one that is moving, albeit slowly, from outsider to mainstream.