KKR and Borealis Maritime joint venture (JV) Embarcadero Maritime III has acquired German based Commerzbank subsidiary Hanseatic Ship Asset Management’s (HSAM) ships for $254.5m.

HSAM was established in May 2013 by Commerzbank, which took over some vessels from debtors and pooled them in this unit. The bank announced its exit from ship financing in 2012.

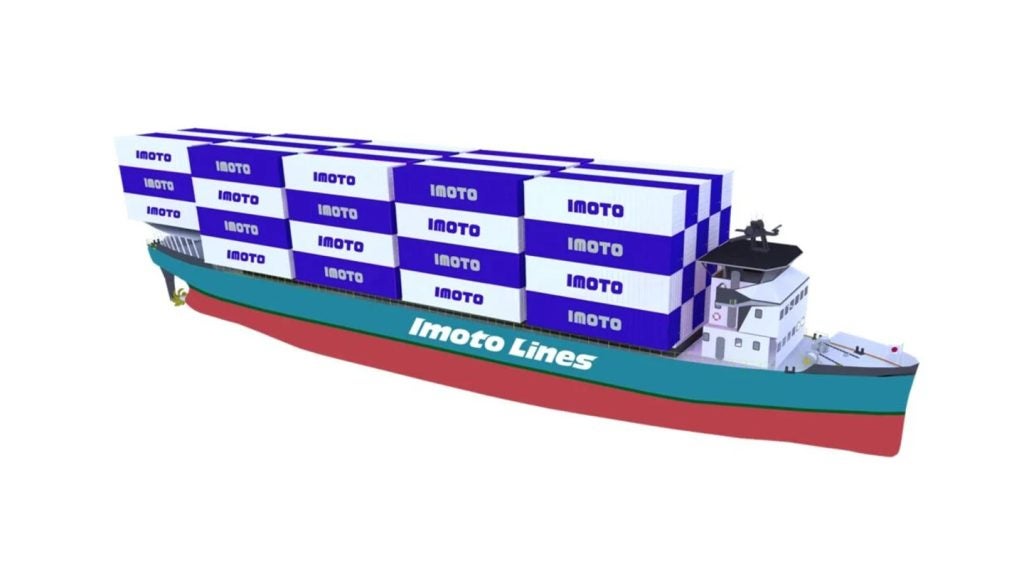

So far, HSAM has acquired a modern fleet of 13 mid-size container vessels and five mid-size dry bulk vessels.

With the acquisition, which will include all of HSAM’s assets, the JV will jointly operate a fleet of more than 50 vessels in the container, chemical, product and LPG sectors.

KKR Special Situations team member Brian Dillard said: “We are pleased to acquire this high-quality fleet from Commerzbank and will continue to explore additional growth opportunities in the shipping sector.

“Partnering with maritime lenders to offer feasible solutions to problematic lending engagements remains a core component of our expansion strategy.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBorealis Maritime CEO Christoph Toepfer said: “The acquisition of HSAM will significantly increase our managed fleet, making us one of Europe’s leading container vessel operators.

“We believe the quality of vessels being acquired from Commerzbank is second to none and this transaction is an attractive expansion of our activities with our partners KKR.”

The transaction, which is funded through KKR’s managed funds and accounts, including its Special Situations Fund II, is subject to approval of the relevant authorities.

Both the companies have deployed more than $600m into vessel acquisitions to date and continue to look for additional transactions.