Knot Offshore Partners has entered into an agreement with Knutsen NYK Offshore Tankers to acquire the latter’s subsidiary Knutsen NYK Shuttle Tankers 16 for $115m.

The deal is expected to close within 30 days, subject to customary closing conditions.

Formed in 2013, Knot operates and acquires shuttle tankers under long-term charters of five years or more. Knutsen NYK Offshore Tankers is the sponsor of Knot.

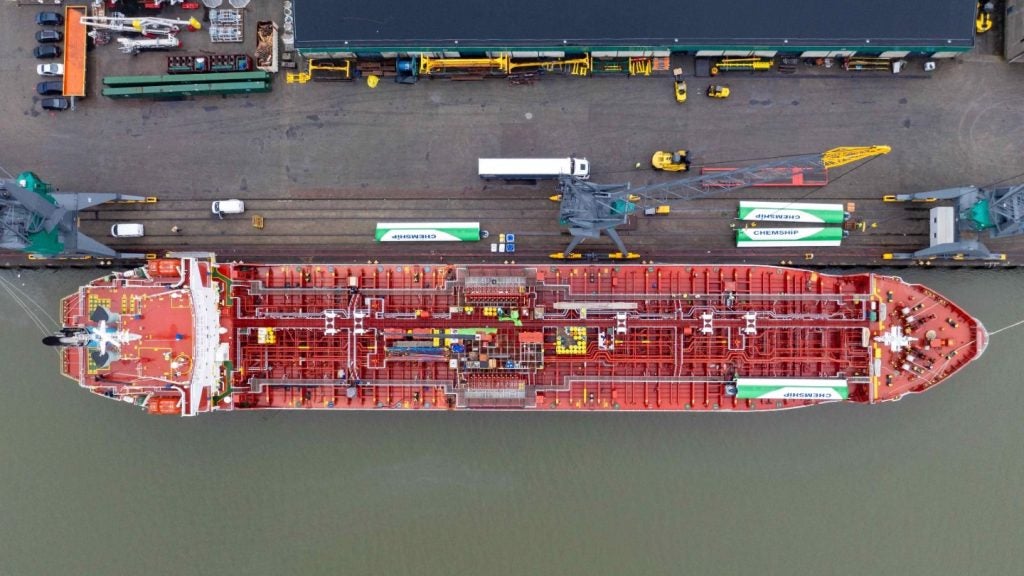

Knot owns and operates a fleet of nine shuttle tankers all chartered with major oil and gas companies. Shuttle Tankers 16 owns the 2013-built Ingrid Knutsen currently operating in the North Sea.

The ten-year time charter of the vessel with Standard Marine Tonsberg will expire in early 2024. There is an option to extend the charter for one three-year period and one two-year period.

The Knot partnership will pay $27m of the net $104.5m outstanding indebtedness to Ingrid Knutsen leaving a sum of $77.5m, to be paid in two tranches.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataTranche one is a commercial bank loan of $22.4m, repayable in semi-annual instalments with the final payment due in December 2018.

Tranche two is an export credit loan of $55.1m, repayable in semi-annual instalments with a payment due in November 2025.

Recently, Knot signed an extension of time charter with Repsol Sinopec Brasil for the Carmen Knutsen for five years.

KNOT Offshore Partners CEO and CFO John Costain said: “The acquisition of Ingrid Knutsen, together with the extension of the Carmen Knutsen time charter, are very positive developments for the Partnership, increasing the average fixed employment of the fleet from five years to 5.8 years and growing the Partnership’s fleet to ten vessels.”

“The Partnership still has the option to acquire the Raquel Knutsen from Knutsen NYK Offshore and will have the option to acquire four additional shuttle tankers from KNOT currently under construction following acceptance by the respective charterer of each such vessel.”

In June, Knot completed the acquisition of the shuttle tanker Dan Sabia, which operates in Brazil, for $103m.