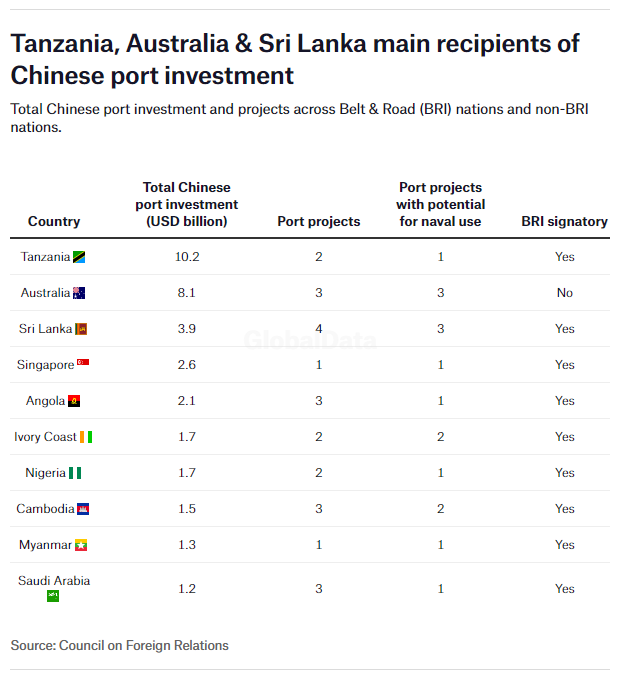

Australia has been the second-largest recipient of Chinese port investment as of September 2023, with US$8.1bn poured into three Australian port projects, according to new data from the Council on Foreign Relations.

Only Tanzania ($10.2bn) has received more from Beijing’s treasury than Australia. China has placed more than double the port investment in Australia than it has in third-ranked Sri Lanka, which has seen inflows of $3.9bn.

What marks Australia out from Tanzania, Sir Lanka and the following ten largest recipients of Chinese investment is the Belt and Road Initiative (BRI). Australia is the only non-signatory to land such significant Chinese investment.

Beijing’s grand plan of infrastructural investment spans 155 countries, or almost 75% of the world’s population.

The Port of Darwin saga

Chinese investment is a source of growing tension in Australia amid fluctuating Beijing-Canberra relations.

Upon gaining office in 2022, Prime Minister Anthony Albanese ordered a review into Rizhao-headquartered Landbridge Group’s lease over the Northern Territory Port of Darwin.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataOn 20 October, this review concluded it was “not necessary” to cancel Landbridge’s lease – but that the government would monitor security arrangements at the Port of Darwin.

Landbridge purchased the 99-year lease for AU$506m ($322m) in 2015, despite US objections over the potential for China to gather military intelligence on Australian and US forces in the region.

The dual-use Darwin contract means Landbridge can engage in both commercial and military practices. More than 2,500 US Marines are stationed at Darwin’s harbour, which the US Marine Corps use for vessel service and resupplying.

Pressure has also been piled on the Australian government to buy back the Port of Newcastle, just north of Sydney, which is part-owned by China Merchants Port Holdings Company.

Similar calls have been made over the Port of Melbourne, Australia’s busiest port, which was bought for AU$9.7bn ($7.3bn) by a consortium backed by investors including China Investment Corp in 2016.

Beijing-Canberra trade war

Geopolitical and military concerns aside, China and Australia have also been vying for control over trade in south-east Asia.

Research from GlobalData shows that China is only behind the US in the total value of transport-related deals completed since 2018. Australia ranks eighth, investing more than $96bn in transport deals.

During a diplomatic trip to the Indonesian capital of Jakarta in September, Albanese announced a new trade strategy for south-east Asia clearly intended to mitigate China’s economic grip on the region.

“We support trade with China, and we’ve been working through some of the issues which have been there,” Albanese said. “We’ll cooperate where we can, and we’ll disagree where we must, and we’ll engage in our national interest”.

Beijing and Canberra entered into a Free Trade Agreement in 2015, but the two nations have been embroiled in regional trade disputes ever since.

The highest point in tensions came when Australia refused to adopt Huawei technology and called out Chinese political interference in 2020, prompting Beijing to respond with a wide-ranging ban on Australian agricultural imports.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.